Meta Q3 earnings next on the agenda – Stock Markets

Meta to report strong earnings after market closes

Focus remains on AI & Metaverse outlook

Meta platforms, the parent company of Facebook and Instagram, will announce third-quarter earnings on Wednesday after the market closes. Forecasts point to notable growth, with the consensus recommendation from analysts polled by Refinitiv being a buy.

Total revenue is expected to show an annual growth of 21% to $33.5bln in the three months to September – double the 11% growth in the second quarter. The family of apps (Facebook, Messenger, Instagram, WhatsApp) has probably experienced a similar whopping expansion, with the advertising segment also rebounding by an equivalent solid percentage.

In other important financial metrics, earnings per share (EPS) are forecast to jump to $3.63 compared to $2.98 in the previous quarter and $1.64 in the same period a year ago. As regards its profitability, net income is expected to grow at the fastest pace in a couple of years – by more than 100%.

Having beat estimates over the past two quarters and with several institutional investors and hedge funds raising their Meta shareholdings and revising their target prices higher recently, the bar is set high for the social networking company.

Is Meta an attractive stock?The negative reaction to Tesla and Netflix as well as Alphabet's mixed results shows that investors are more sensitive to data misses this time, and is unable to repeat July's rally. Despite current uncertain market conditions and ongoing lawsuits, Meta platforms could still shine in the tech world and attract investors even if the stock price declines.

Engagement is a powerful tool for the giant social media company, making it hard for anyone to find any easy alternative to connect with friends and family and get updated on local and global news. It’s even more impressive to know that the planet has a population of nearly 7.9 billion and almost half of it is actively using its Facebook account on a monthly basis. That’s definitely a plus for developing its Metaverse world and incorporating its AI tools in everyone’s life at a faster pace than its peers.

The lack of alternative social media platforms could make charges difficult to avoid for those who don’t want to share their digital activity with the company. Note that Meta is planning to charge its European audience $14 monthly for ad-free Facebook and Instagram or $17 for both and on desktop. While this might cause some discomfort among members it could be a new source of revenue diversification for the company besides the monetization of Reels and advertising. On that front, it would be interesting to learn whether the company plans to expand its charges to other regions too.

Expenses could growOn the other hand, the ongoing transition to Metaverse and the expansion of AI will not come at a cheap cost as competition gets more intense. Meta aims to start training a new AI model, which will be a more advanced version than its open-source AI language model Llama 2 and be a serious competitor to chatGPT, as soon as in early 2024. Other exciting AI projects are also in the pipeline, including chatbots based on celebrities and features connected to Ray-ban glasses, while improvements on the virtual reality front are also on the way following the release of the new Quest 3 headset.

During its previous earnings release, Zuckerberg’s group of companies said that total expenses could increase to $88-91 billion by the end of 2023 and further grow in 2024 providing no specific number for the latter. Any guidance of expenses growing below $100bln or at least below revenue growth could be market positive amid elevated interest rates and wages and heightened geopolitical risks.

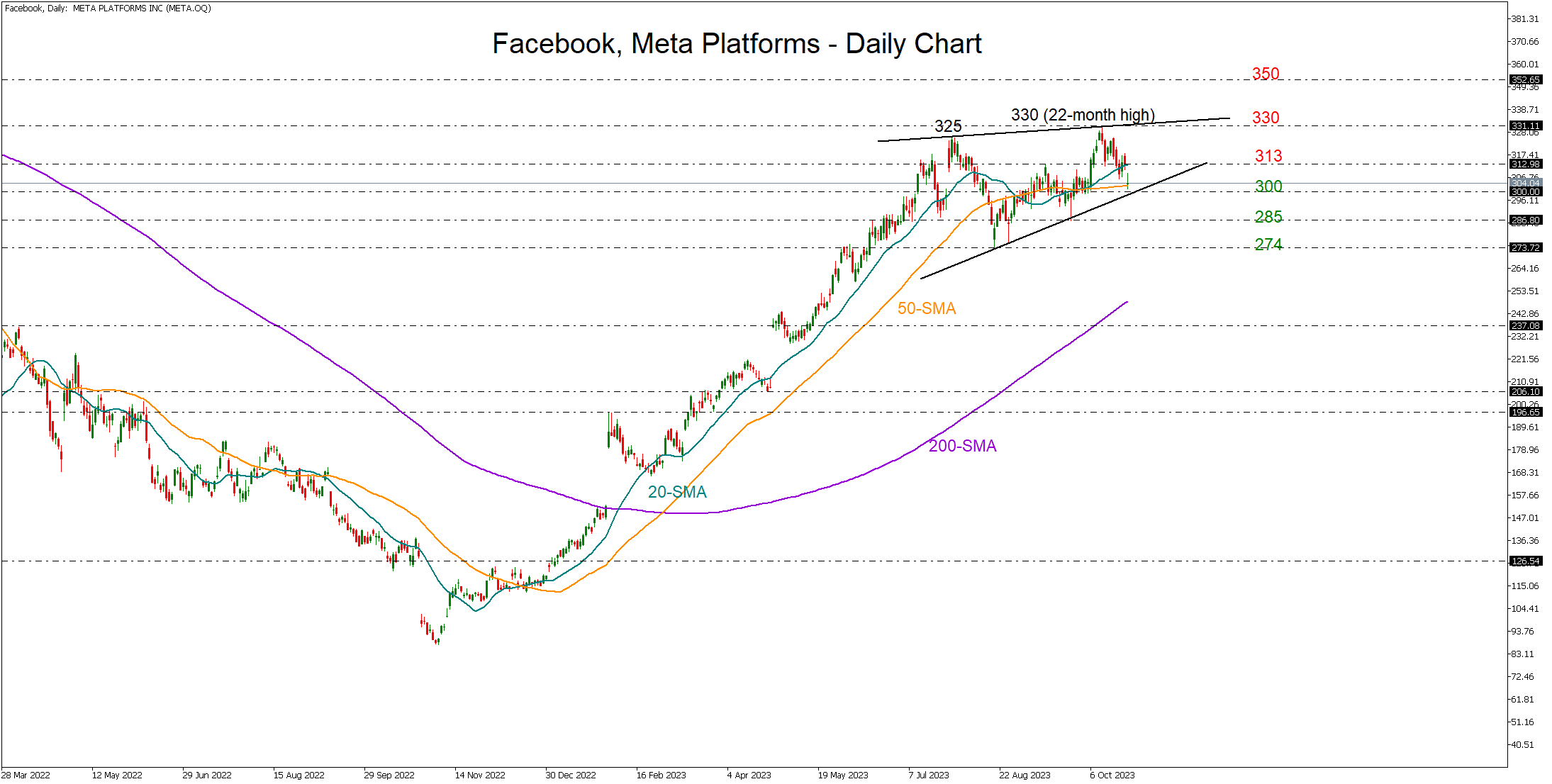

Levels to watchTurning to stock markets, Meta’s stock has been the second-best performer after NVIDIA in the S&P 500 space during 2023, trading 159% higher year-to-date compared to the index’s gain of 10%. Stronger-than-expected advertising revenues and a brighter outlook for the final quarter of 2023 could be good news for the stock as recession fears and geopolitical risks weigh on sentiment. Should the price bounce back above the 20-day simple moving average (SMA) at 312, the door would open again for the 2023 peak of 330. The 2021 resistance of 350 could be the next obstacle.

Alternatively, a miss in earnings and signals of more challenging years ahead could squeeze the stock below the 50-day SMA and the 300 level, shifting the attention to the 285 constraining zone and then to the August trough of 274.

Related Assets

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.