Market Comment – Yen tumbles to fresh lows, dollar awaits GDP

Yen falls to new 34-year low ahead of BoJ decision

Dollar traders await GDP and PCE data

Wall Street mixed, gold stays on the back foot

Will Ueda appear in a hawkish suit this time?

Will Ueda appear in a hawkish suit this time?The yen extended its tumble to a fresh 34-year low, falling below 155.00 per dollar. With less than 24 hours to go for the Bank of Japan’s decision, investors are likely sitting on the edge of their seats in anticipation of the gathering’s outcome.

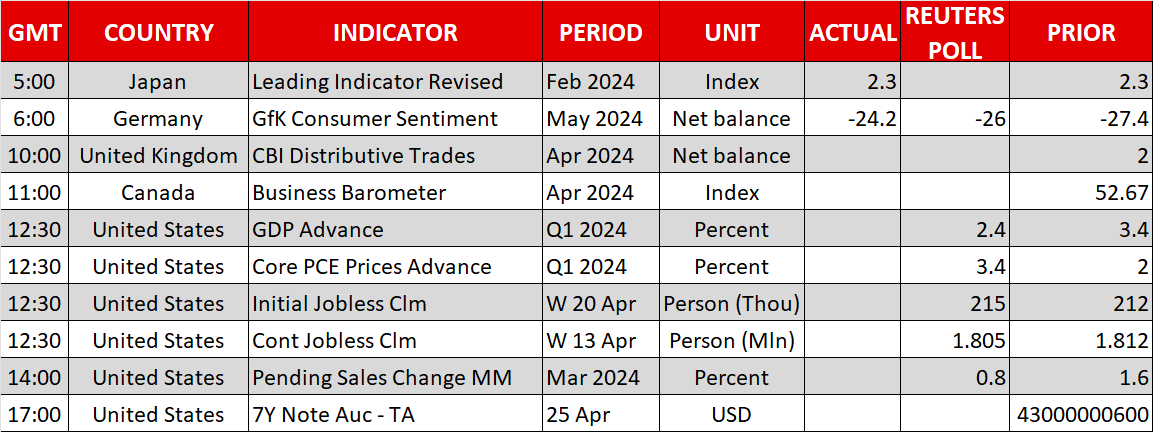

Recently, Governor Ueda said that they may raise interest rates if the yen’s declines result in accelerating inflation and added that they could begin reducing their huge bond buying at some point. With inflation accelerating notably in February, despite ticking a bit down in March, and taking into account that the wage negotiations resulted in the largest pay hikes in 33 years, investors may be on the lookout for hints and clues on how soon the next hike will be delivered. Currently, they are expecting the next 10bps hike in June.

However, the BoJ has a history of disappointing hawkish expectations, and thus should this be the case again, the yen is likely to continue falling and perhaps revive intervention concerns. That said, officials could wait for a while longer before stepping in, given that they have repeatedly warned that they will respond if the moves are speculative and not based on fundamentals. Indeed, they have been silent lately perhaps as the latest leg south in the yen was driven by fundamentals.

The BoJ has a history of disappointing hawkish expectations, and thus should this be the case again, the yen is likely to continue falling

On the other hand, Ueda may want to make sure he avoids a 2022 déjà vu, when Kuroda’s dovish remarks pushed the yen off the cliff and forced authorities to intervene and save the currency. So, he could decide to adopt a more hawkish stance.

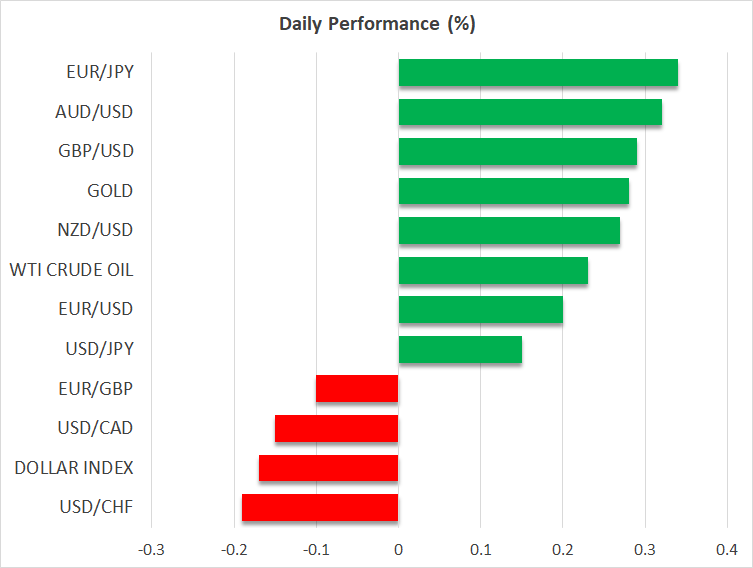

Will the Fed refrain from cutting rates this year?Although it gained ground against the yen, the dollar traded on the back foot against most of its major peers, perhaps as traders were reluctant to initiate new long positions ahead of the US GDP data later today.

Expectations suggest that growth in the world’s largest economy slowed to an annualized 2.4 q/q in Q1 from 3.4%, but with the Atlanta Fed GDPNow model pointing to a 2.7% growth rate, the risks may be titled to the upside. Following the downside in the S&P Global PMIs on Monday, investors may need to see stellar GDP data before they further scale back their rate cut bets, and thereby allow the dollar to stage a comeback.

Investors may need to see stellar GDP data before they further scale back their rate cut betsWall Street set to open lower, gold extends correction

US equities closed mixed on Wednesday as stock traders remained cautious as well ahead of the GDP data. However, after the closing bell, although Meta reported better than expected results for Q1, its shares plunged more than 15% on weak revenue guidance, increasing the risks for a lower open on Wall Street today. The tech earnings continue today with results from Microsoft and Alphabet.

Gold traded a bit lower yesterday as the easing geopolitical tensions allowed investors to continue offloading safe-haven positions. However, central bank buying, and strong Chinese demand remain big supportive factors, keeping the outlook positive. What's more, although delayed, the next move on US interest rates is more likely to be a cut, which is positive for the yellow metal.

However, central bank buying, and strong Chinese demand remain big supportive factors, keeping the outlook positive

Related Assets

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.