Market Comment – Stocks in the green, dollar stable as next batch of US data awaited

Stocks feeling more positive following the US PMI miss

Busy earnings calendar as focus remains on US data prints

Dollar/yen remains a tad below 155 ahead of the BoJ meeting

Aussie benefits from stronger CPI report

Market wants more of the PMI surveys medicine

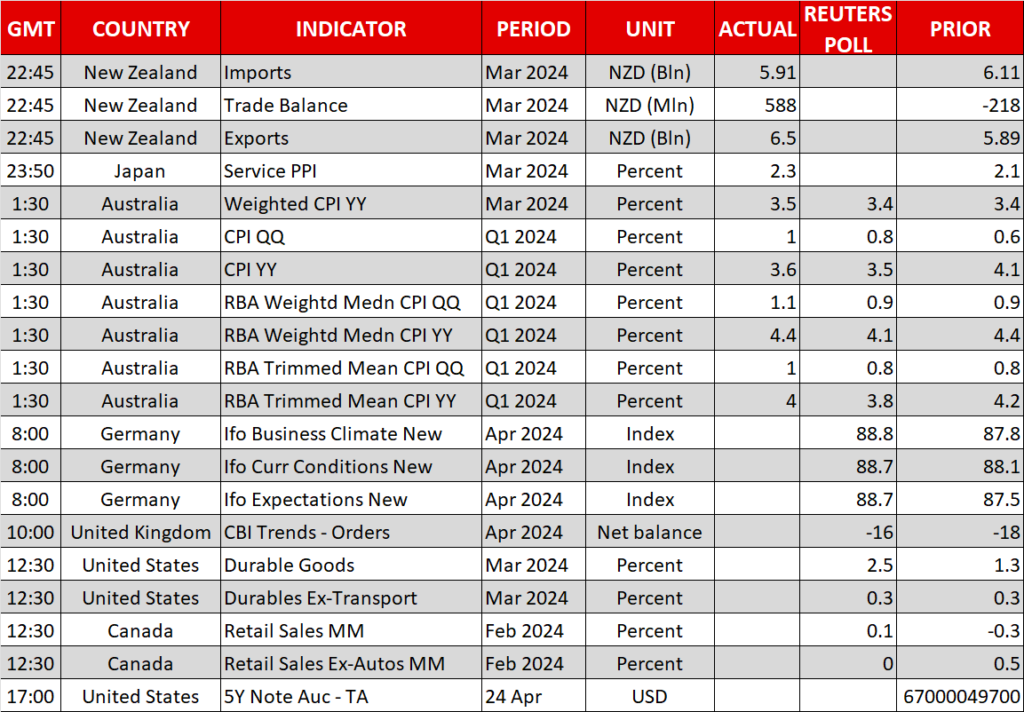

Market wants more of the PMI surveys medicineThe recent US data prints and particularly the mid-April inflation report has clearly alarmed the market of the possibility that the Fed could keep its rates unchanged in 2024. This is quite a shift considering that in January the market was confident that six rate cuts would be announced this year by the Fed.

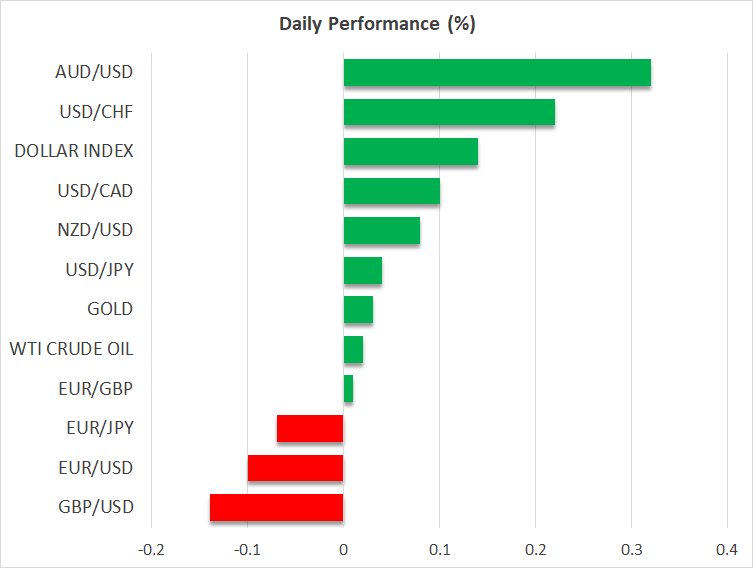

However, after several difficult days, the US stock market really enjoyed yesterday’s session. The downside surprise by the US PMI surveys changed the market’s momentum with the S&P 500 recording its stronger daily rally since February 22.

The downside surprise by the US PMI surveys changed the market’s momentum with the S&P 500

Weak durable goods orders later today will most likely maintain the positive sentiment in stocks, but the short-term outlook is clearly dependent on Thursday’s preliminary GDP print. While the market acknowledges some upside risk to the current forecast for a 2.4% annualized growth, a stronger print might cause another correction in stocks.

Earnings proving more positive than forecastThe earnings round continues with Meta reporting after the market close today, and both Microsoft and Alphabet announcing their results tomorrow. Tesla published its details for the first quarter of 2024 yesterday and despite announcing worse figures than widely expected, equity investors were in a relatively good mood and pushed the stock higher in after-hours trading. The trigger was Tesla’s plan to launch new models, some of them more affordable than the current offering.

Also yesterday, Visa reported a jump in its revenues on the back of stable consumer spending. This is probably going to alarm the Fed doves as the higher cost of money does not appear to dent consumer appetite and thus still fueling inflation.

Dollar maintains its recent gainsThe dollar did not enjoy the same positive market momentum with euro/dollar hovering today around the 1.07 level. The stronger euro area preliminary PMI surveys gave a lift to both the euro and European equities, but the momentum could quickly change upon the next weak euro area data print.

In addition, there are increasing noises that the ECB much-touted June rate cut is not exactly set in stone and that the ECB is not exactly ready to embark on an easing spree with the Fed remaining on the sidelines. ECB’s Nagel and Schnabel will be on the wires later today.

Τhere are increasing noises that the ECB much-touted June rate cut is not exactly set in stone

In the meantime, dollar/yen remains a tad below the 155 threshold as the market keeps testing the Japanese authorities’ reaction function. The preliminary PMI surveys yesterday were positive but Friday’s inflation outlook report will play a key role in the BoJ meeting's outcome. The market does not expect another rate hike on Friday.

Aussie rallies on the back of stronger CPIThe Australian inflation report for the first quarter of 2024 surprised on the upside earlier today. The aussie reacted positively to the release by recording the fourth consecutive green session against the US dollar. The RBA was always seen as the least dovish central bank with the market currently assigning zero possibility of a rate cut during 2024.

Related Assets

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.