Market Comment – Dollar climbs above 150 yen as Treasury yields rebound

Treasury yields rebound, lift the dollar ahead of US GDP data

Dollar/yen rises past 150, rings intervention alarm bells

ECB to take the sidelines, focus to fall on forward guidance

Wall Street tumbles as Alphabet disappoints

Will US GDP data add more fuel to the dollar’s engines?

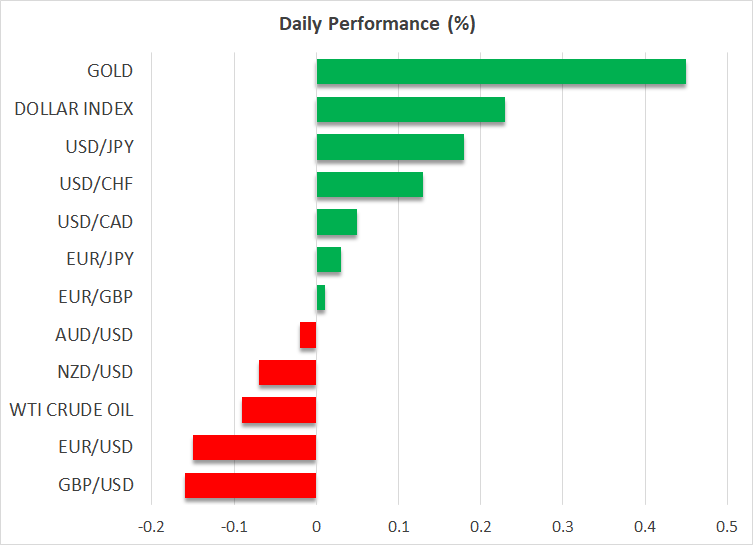

Will US GDP data add more fuel to the dollar’s engines?The US dollar extended its gains as US Treasury yields rebounded, with the 10-year benchmark rate resuming a move towards the psychological zone of 5.0%, briefly breached on Monday.

Yet, Fed funds futures point to a virtually unchanged implied rate path, with a 40% probability for one last 25bps hike by January and around 75bps worth of rate cuts for next year. This means that there is room for upside adjustment should upcoming data corroborate the view that the US economy is faring well, which could add further fuel to the dollar’s engines and perhaps propel the 10-year yield above 5.0%. Should this happen, the next territory that could tempt investors to jump into the bond market may be at around 5.3%, a zone that halted further advances in yields back in June 2006 and June 2007.

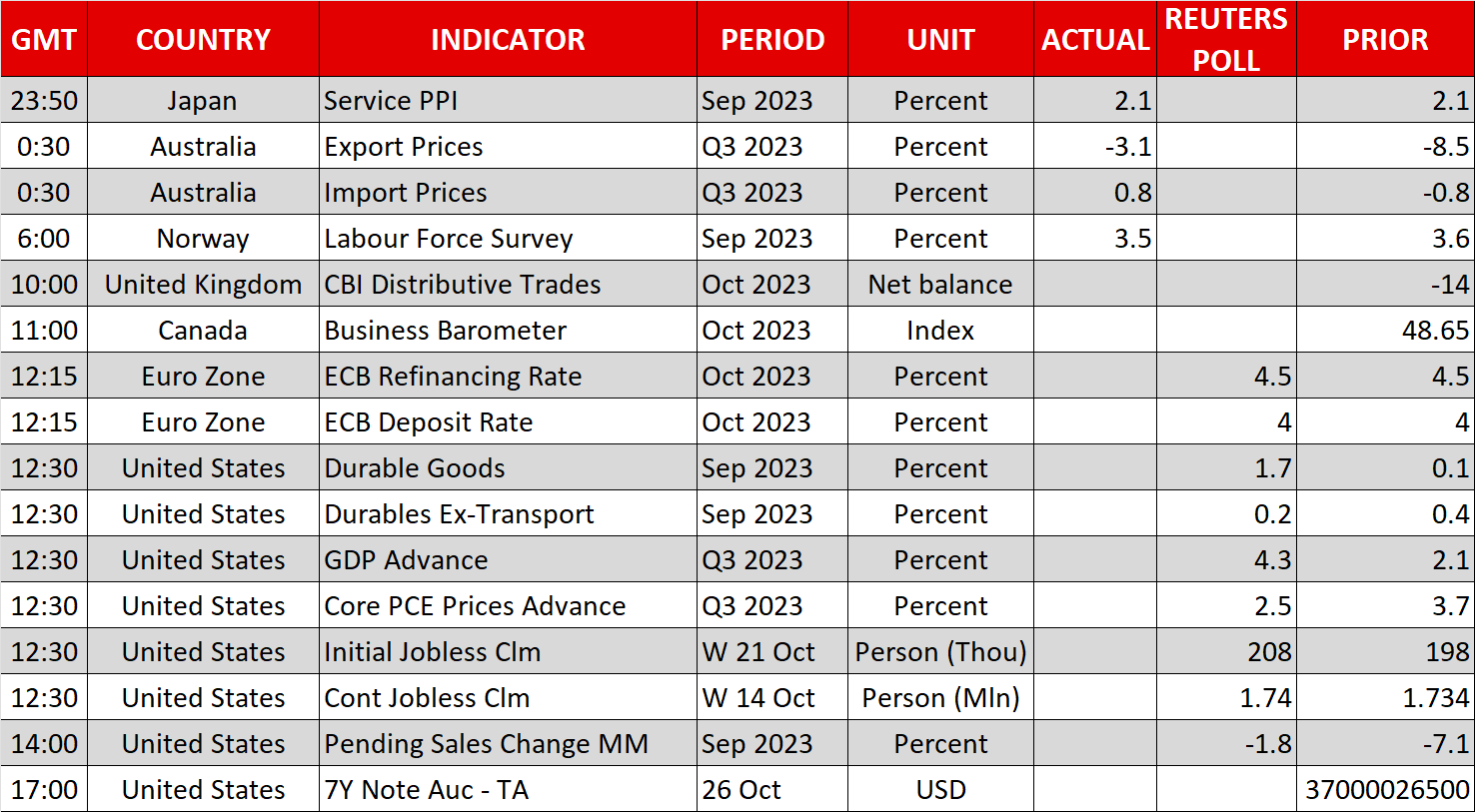

Today, dollar traders may keep their gaze locked on the US GDP data for Q3. Expectations are for the world’s largest economy to have enjoyed double the growth rate it posted in Q2, with the risk perhaps tilted to the upside as the Atlanta Fed GDPNow model estimates an even higher growth rate than the official forecast of 4.3%.

To intervene or not to intervene?The dollar pair that attracted the most attention was dollar/yen, which forcefully pierced through the psychological 150 zone yesterday, and with no interruption by Japanese authorities, it continues marching higher today, trading at around 150.60.

Nonetheless, that doesn’t mean intervention is not likely anymore. Perhaps officials are just considering a higher level at which they could step in. Indeed, earlier today, Japanese Finance Minister Suzuki warned against selling the yen, adding that they are watching market moves with a sense of urgency.

A positive reaction to a better-than-expected US GDP today could prove to be the intervention trigger, but with the BoJ maintaining a lid on Japanese government bond (JGB) yields and the rally in US Treasury yields showing no signs of abating, the pair may be destined to resume its prevailing uptrend at some point, even if Japanese officials act.

For the yen to stage a noteworthy and sustained recovery, the BoJ may need to alter its ultra-loose monetary policy soon. According to sources, officials have already discussed the possibility of a further yield cap hike.

ECB takes the central bank torchBesides the US GDP data, there is also an ECB meeting on today’s agenda. When they last met, ECB officials raised interest rates by 25bps, but they signaled that this was probably the last hike in this tightening crusade.

Since then, several officials have argued that inflation could return to their 2% objective even without any additional hikes, while economic data continues to point to a wounded euro area economy. This convinced market participants no more rate increases will be delivered and allowed them to price in around 65bps worth of cuts for next year.

Therefore, the attention will fall on clues and hints on whether policymakers are indeed considering the reduction of interest rates at some point next year, with anything validating this notion having the potential to further hurt the euro.

The Bank of Canada announced its own decision yesterday, refraining from pushing the hike button and forecasting weak growth, although it kept the door open to more hikes if deemed necessary. The loonie traded on the back foot against its US counterpart, perhaps as its traders continued seeing a very slim probability for another increase.

Alphabet’s cloud earnings miss drags Wall Street lowerWall Street tumbled yesterday, with the tech-heavy Nasdaq losing more than 2% after Alphabet reported disappointing cloud services revenue, even as rival Microsoft’s Azure took off. After Wednesday’s closing bell, Meta Platforms beat Wall Street’s high expectations, but its stock fell after the company warned of weakening advertising demand. This could result in a lower market open today. Amazon will take its turn in reporting results after today’s close.

Related Assets

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.