Is the 5,000 milestone in sight for the S&P 500? – Stock Markets

Mega-cap stocks drive S&P 500 towards 5,000 milestone

AI and tech dominate the bull charge to unchartered territory

But how sustainable is the uptrend?

It wasn’t the best start for Wall Street in 2024 as the major indices stumbled during the first week of the new year. However, it didn’t take long for Fed rate cut expectations to take off again and revive risk appetite. More recently, the artificial intelligence (AI) mania has made a comeback, fuelling the rally even more.

As demonstrated during the pandemic, tech stocks are seen to be somewhat immune to negative shocks to the global economy. Add to that the growth potential that the integration of AI can deliver, most investors have come to the conclusion that you can’t go wrong with the Big Tech, which are best placed to tap into all of AI’s capabilities.

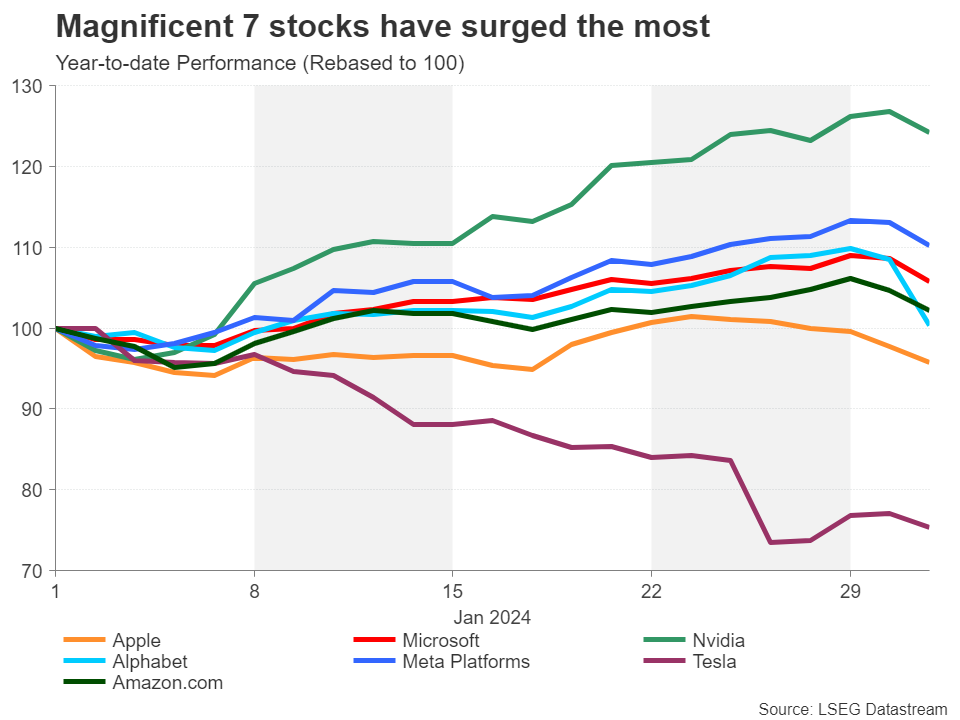

The AI craze isn’t overThose that are ahead of the AI race like Microsoft and Nvidia, have seen their shares outperform. Those deemed to not be doing enough to capitalize on the latest hype, have been lagging. Apple and Alphabet unusually fall into the latter camp, while Facebook’s parent Meta has been a surprise winner as the company has quietly been launching several AI tools such as chatbots on its platforms.

But whilst the primary drivers of this latest bullish phase have been the tech stocks belonging to the Magnificent Seven, other mega-cap stocks have also been enjoying strong gains in January.

Outside of the Big TechWithin the broader tech sector, IBM has come back into favour amid its push away from hardware and towards cloud-based services. Intel hasn’t been as fortunate as it’s failed to convince investors that it’s on the right track when it comes to keeping up with the competition despite decent earnings. AMD on the other hand has maintained optimism about its earnings prospects even though its latest offerings have yet to boost its revenue significantly.

It's not all rosyThe biggest threat, though, to unravelling all the euphoria are further potential disappointments from Apple and Google owner Alphabet. Excluding the Vision Pro headset, which isn’t a mainstream product, Apple hasn’t launched anything very exciting in years, while its highly anticipated fully autonomous Apple Car debut keeps getting pushed back. As for Alphabet, its cloud revenue growth hasn’t been as impressive as Microsoft’s or Amazon’s and the slow development of its AI-based services has frustrated investors.

Non-tech winnersThe good news for Wall Street is that there are bright spots outside of the tech arena too. Pharmaceuticals have had a strong start to the year, led by the likes of Eli Lilly and Merck, and so have telecommunication and software stocks such as Verizon and Salesforce.

This has meant that the Dow Jones Industrial Average made up mostly of ‘old economy’ stocks has been doing almost as well as tech-heavy Nasdaq 100 this year. The S&P 500 has a slight lead over both, however, and could soon be making headlines about passing the 5,000 mark for the very first time.

As S&P 500 approaches 5,000, mind the gapWith the earnings season not going entirely smoothly after the disappointing results from Tesla and Alphabet, and the Fed signalling at its January meeting that rate cuts are not imminent, reaching that milestone might have to wait.

The 50-day moving average slightly above the 4,700 level could be a convenient support area in the event of a sizeable short-term pullback. But if buyers return, the 5,000 level is within grasp and won’t require much effort to seize it.

A dangerous trend?Looking ahead, the main challenge for the S&P 500, Dow Jones and Nasdaq will be to prevent mega-caps from increasing their domination even more. In particular, the influence of the Magnificent Seven over the entire stock market is reaching alarming levels, as together, they make up almost 30% of the S&P 500.

The danger with this trend is not just the risk of the benchmark indices being hit hard should the Magnificent Seven come crashing down, but also that the more dominant they become, the more funds they will attract, leaving small caps left out in the cold.Related Assets

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.