Daily Market Comment – Markets calm before the central bank storm

Massive week begins, featuring rate decisions in US, Europe, and Japan

US inflation report also on tap tomorrow, could influence Fed decision

Yen hits seven-year low against pound, Turkish lira goes into freefall

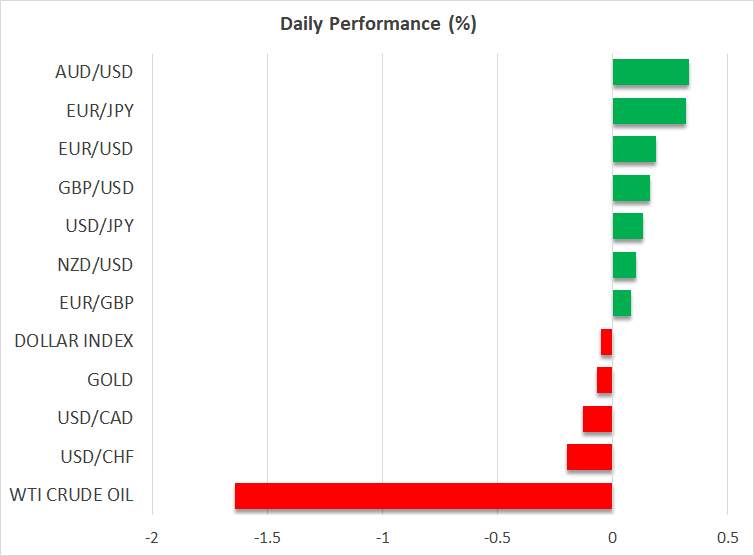

Calm ahead of key events

A bombshell week lies ahead for global markets. Interest rate decisions in the United States, Eurozone, and Japan will almost certainly fuel volatility in every asset class, especially if the rhetoric of these central banks deviates from the prevailing market consensus.

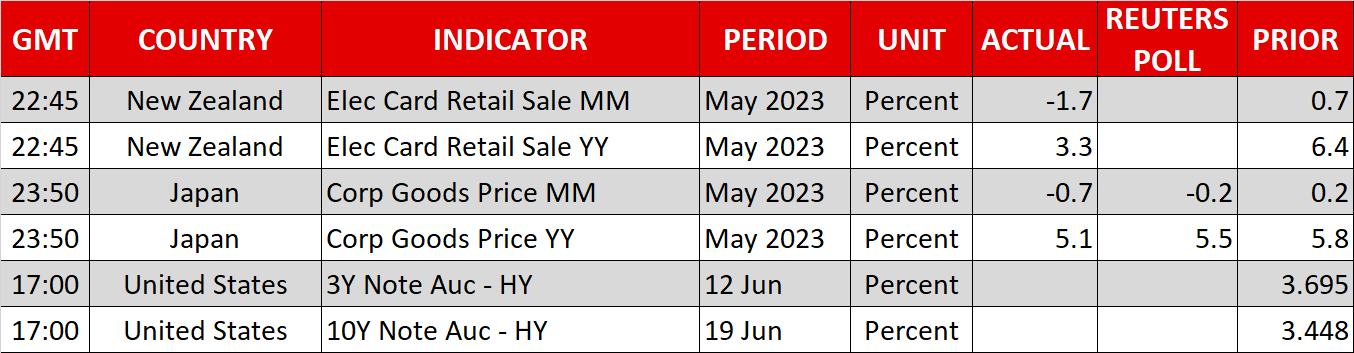

In the United States, the ball will get rolling tomorrow with the release of the latest CPI inflation data, which will be instrumental in shaping expectations around the Fed decision on Wednesday.

Even though the US economic data pulse is still pretty strong, with the labor market in good shape and GDP growth on track to hit 2% this quarter, market pricing only assigns a 25% probability for a rate increase this week. That’s because several Fed officials have signaled they prefer to ‘play it slow’ and examine incoming data before raising rates again.

Unless something dramatic changes after tomorrow’s CPI data, the Fed will probably ‘pause’ the tightening cycle this week, shifting the emphasis to the updated rate projections and any messages about the likelihood of resuming rate hikes in July. Hence, the reaction in the dollar will depend on several elements, including also how foreign central banks behave.

ECB could disappoint euro

Over in the Eurozone, the economy has fallen into a technical recession but that’s unlikely to stop the European Central Bank from raising rates on Thursday. A rate increase of 25bps is fully priced in, as the ECB has telegraphed its intentions well in advance.

Therefore, this meeting will be about how the ECB wishes to move forward. Market pricing suggests another rate hike is in the pipeline for July, yet the central bank might refuse to pre-commit to that, as incoming data suggest economic growth is rolling over and inflation is cooling.

Under these circumstances, the ECB is more likely to preach caution and patience, keeping its options open. The economy is already contracting and the last thing the central bank wants is to pour gasoline on the recessionary fire. If the ECB mimics the Fed and signals it might ‘take a break’ next month, the euro could be left disappointed.

GBP/JPY reaches highest levels since 2016

The past few months have been a perfect storm for pound/yen, which is trading at its highest levels since 2016, turbocharged by a blend of central bank divergence and favorable risk sentiment. Rate differentials have widened lately as investors bet the Bank of England will be forced to keep tightening but the Bank of Japan won’t join the race anytime soon, and the euphoric tone in stock markets has been similarly advantageous for risk-correlated FX pairs.

What the BoJ does on Friday could decide whether the yen keeps sinking. The Japanese economic landscape has improved by leaps and bounds, but it’s likely too early for the BoJ to hit the tightening button as many officials are concerned the recent victories on inflation and wages won’t be sustained. If the BoJ remains sidelined, that would leave the yen at the mercy of external forces, namely how risk appetite evolves.

Finally, the Turkish lira has gone into freefall, hitting another record low this week. The appointment of Gaye Erkan as central bank governor on Friday did nothing to calm the currency crisis, despite speculation she could triple interest rates to 25% from 8.5% currently. It seems even the prospect of dramatically higher rates is not enough to soothe investors' concerns, given the risk that such a sharp tightening in credit conditions will ultimately produce a recession.

Related Assets

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.