Daily Comment – Geopolitics dictates market sentiment, but dollar fails to benefit

- Geopolitics in the spotlight, gold gains

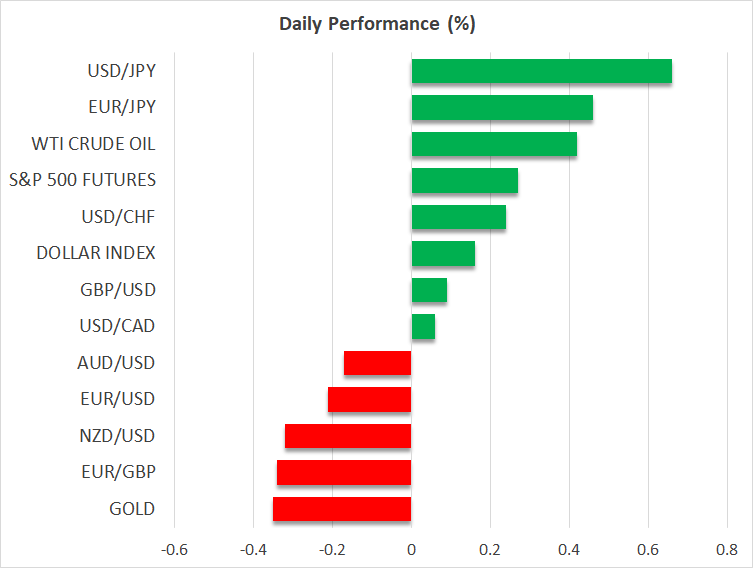

- Dollar fails to benefit from the risk-off reaction

- Stocks slightly in the green, as markets await Nvidia earnings

- Pound gains after CPI report; bitcoin reaches $94,000

It almost feels like the Cold War again

Developments in the Ukraine-Russia conflict are monopolizing the markets' interest, as the first usage of long-range US missiles prompted a quick revision of Russia’s nuclear weapons doctrine. President Putin has approved the potential use of nuclear weapons as a response to a large-scale attack with conventional weapons. The current situation bears resemblance to the Cold War, when the two superpowers were at each other’s throats almost on a daily basis.

The markets reacted negatively to the perceived escalation and the aggressive rhetoric from both sides, with gold recording its best two-day rally since early March, when the markets were mentally preparing for the Fed rate easing cycle. Gold has suffered the most following Trump’s win, but the bulls have managed to regain a small chunk of their recent losses.

Dollar fails to rally again

Interestingly, the dollar has once again failed to materially benefit from the risk-off sentiment, with euro/dollar hovering around 1.0570. This is the second time in less than five days that the dollar did not rally in response to typically dollar-positive developments. Last week’s comments from Fed Chair Powell about the Fed not being in a hurry to cut rates did not cause a reaction from the dollar bulls, which could indicate that positioning is not favouring further dollar strength.

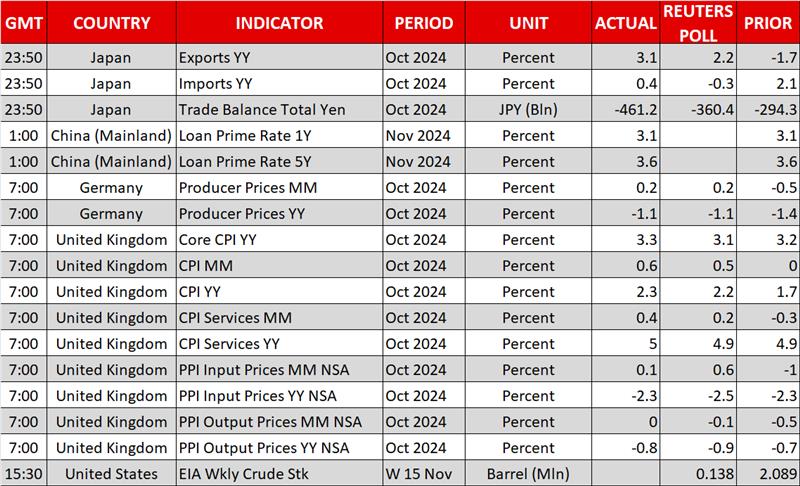

With the data calendar being extremely light, the focus will remain on Fedspeak. Fed members Cook, Collins, Barr and Bowman will be on the wires during today’s session, with the market paying extra attention to the Fed doves’ rhetoric.

Pound rallies on stronger inflation data

A plethora of comments from BoE members yesterday did not offer much in terms of the rates outlook. The BoE is trying to balance the elevated inflation, particularly in the services sector, but its job has been complicated by the unknown impact of the recently announced budget measures by the UK government, especially the planned national insurance increases.

The market is convinced that the December meeting will not hold any surprises, a view that got extra support from today’s inflation report. Headline CPI rose to 2.3% in October, but the real surprise for the BoE doves is probably the decent pickup in core inflation. Coupled with the improvement in producer price indices, the chances of a December BoE rate cut have further diminished.

Big day for stock markets

US stocks managed to eventually overcome the risk-off sentiment, with the Nasdaq 100 index leading the rally, as the markets are preparing for today’s Nvidia earnings release. There are strong expectations for another spectacular report, which means that a possible disappointment today could quickly shift the current fragile market sentiment to a negative stance.

Bitcoin continues its journey higher

Meanwhile, bitcoin ignored the geopolitical tensions and instead recorded another all-time high above $94,000, as the cryptocurrency world remains on fire. Bitcoin is up 32% in November, a traditionally strong month for cryptos, but other cryptocurrencies, like Ripple’s XRP, have doubled in value since the US election.

Related Assets

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.