Banks Q1 earnings: Weak results despite stock outperformance – Stock Markets

US banks kick off Q1 earnings on Friday before opening bell

Earnings set to drop despite the robust US economy

Valuation multiples rise but remain historically cheap

Solid quarter due to Fed repricing

The banking sector started the year on the wrong foot as expectations of six rate cuts by the Fed had delivered a strong hit to their net interest margin outlook. This metric is essentially the difference between the interest income generated by long-term assets such as loans and the interest expense paid to short-term liabilities such as deposits.

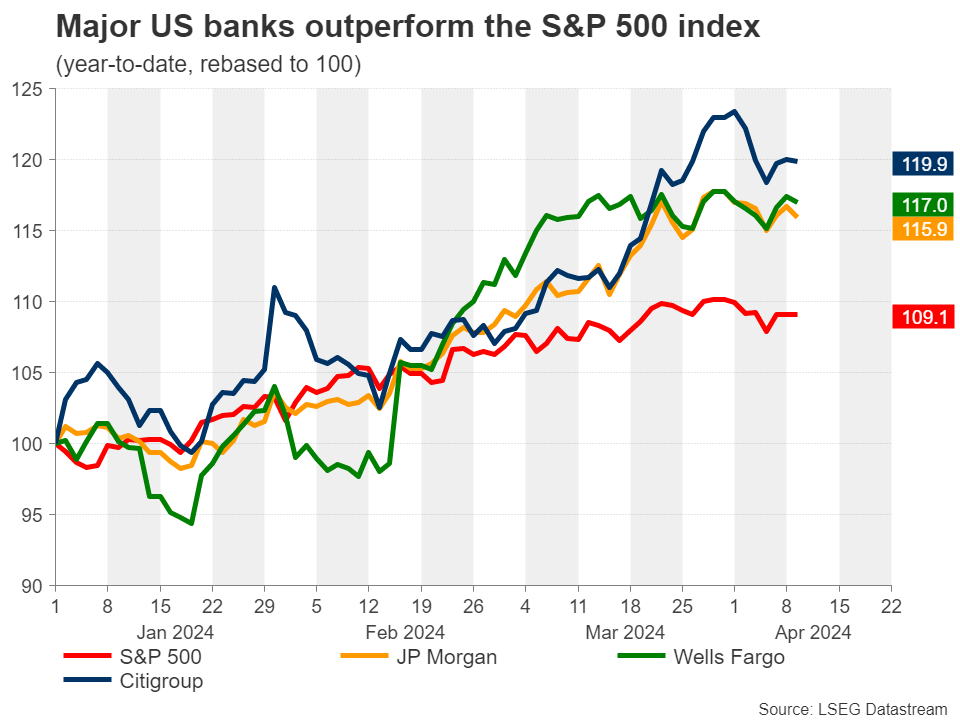

However, a barrage of upbeat macro US data prompted markets to dial back interest rate cut projections, with current market pricing implying a little less than three rate cuts in 2024. In turn, investors became more confident that the banks could preserve their wide net interest margins, which led to their stocks outperforming the S&P 500 index in 2024.

Focus on interest rates and economy

Moving forward, the interest rate trajectory as well as the health of the US economy will play a huge role on banks’ performance. For now, a strong economy has kept loan growth at considerable levels, while preventing a rise in non-performing loans.

Nevertheless, the repricing around Fed expectations has raised concerns for banks. Financial institutions are currently sitting on a pile of unrealised losses in their bond portfolios, and a forced liquidation in case of an exogenous event or a systemic crisis could result in enormous losses. Moreover, high interest rates continue to restrict dealmaking activity and put stress on risk-sensitive sectors such as real estate, in which investment banks have significant exposure.

But in any case, annual comparisons on net interest margin figures are going to be tough from now given that the Fed is on track to begin its rate cutting cycle sooner or later. Therefore, banks would like to see this weakness being offset by a rebound in M&A and dealmaking activities.

JP Morgan retains crown

JP Morgan was the best performing bank in 2023, recording the biggest annual profit in US banking history. Despite its relative outperformance against the other two examined financial institutions, JP Morgan is expected to show some signs of weakness in this earnings season.

Specifically, earnings per share (EPS) of the banking behemoth are estimated to have taken a hit for a second successive quarter, dropping 3.91% from a year ago to $4.15, according to consensus estimates by LSEG IBES. However, the bank is anticipated to record revenue of $41.83 billion, which would represent a year-on-year increase of 6.36%.

Wells Fargo set for a bad quarter

For Wells Fargo, the fundamental picture does not look that great. The bank is set to experience a deterioration in both its revenue and EPS figures, mainly driven by a narrowing net interest margin.

The bank is on track for a 2.54% annual decline in its revenue, which could reach $20.20 billion. Meanwhile, EPS is forecast to fall from $1.23 in the same quarter last year to $1.09, marking an 11.48% drop.

Citigroup’s major restructuring yet to provide results

Citigroup will face another tough earnings season despite its stock outperformance since the beginning of the year. The main reason behind this weakness is that its costly restructuring has not come to fruition yet.

The major investment bank is set to post an annual revenue drop of 4.92% to $20.39 billion. Moreover, its EPS is projected at $1.20, a whopping 35.50% decrease relative to the same quarter last year.

Discount in valuations persists

Although bank stocks have rallied hard since the beginning of the year, their valuations remain relatively subdued. Banks have not yet reached their pre-pandemic multiples even in a period of elevated interest rates, which is considered beneficial for financial institutions. At the same time, the S&P 500 is trading at 21 times forward earnings, way above its historical averages.

That said, the risks seem asymmetric at current levels as there might not be much downside even if we get a major negative surprise in upcoming earnings reports, considering how cheap valuations are.

Related Assets

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.